Commission calculator paycheck

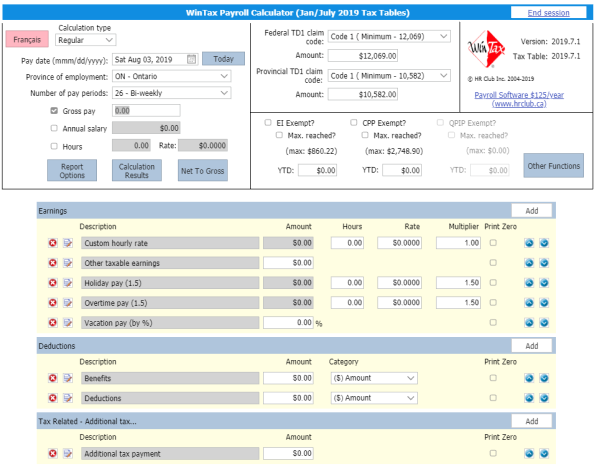

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

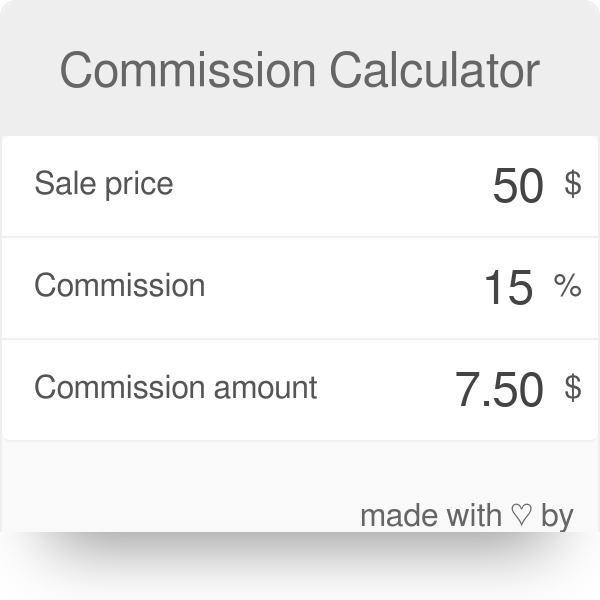

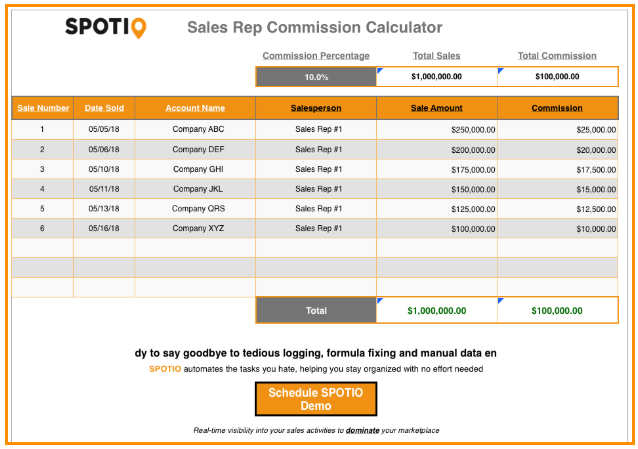

Learn How To Create A Sales Commission Calculator

Get an accurate picture of the employees gross pay including overtime commissions bonuses and more.

. Overtime worked bonus commission and salary. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Switch to California hourly calculator.

Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45. Need help calculating paychecks.

If the employee is hourly you should see four fields. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. A financial advisor in West Virginia can help you understand how taxes fit into your overall financial goals.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Texas Hourly Paycheck and Payroll Calculator. A financial advisor in Arizona can help you understand how taxes fit into your overall financial goals.

To ensure that employers comply with the laws governing the payment of wages when an employment relationship ends the Legislature enacted Labor Code Section 203 which provides for the assessment of a penalty against the employer when there is a willful failure to pay. That puts Oklahomas top income tax rate in the bottom half of all states. Buyers agents usually prioritize homes and showings based on their potential paycheck.

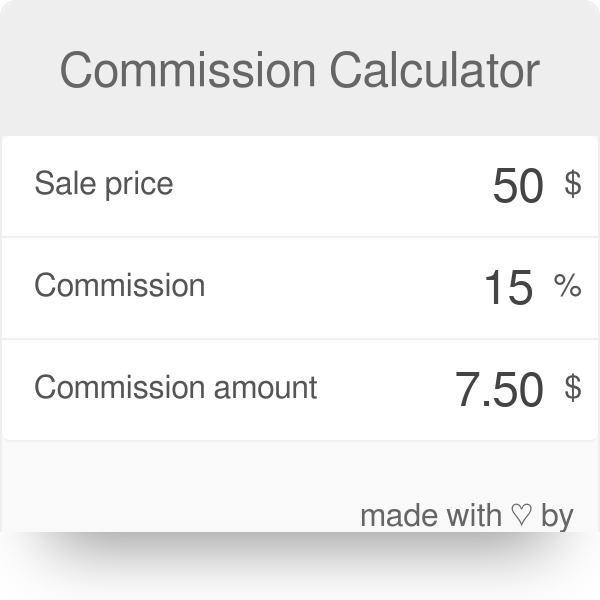

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. In other words if you make a sale for 200 and your commission is 3 your commission would be 200 03 6. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Texas.

What does eSmart Paychecks FREE Payroll Calculator do. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

How You Can Affect Your Wisconsin Paycheck. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The Sooner States property taxes are also below average with an average effective rate of 087 25th-lowest in the US.

How You Can Affect Your Alabama Paycheck. Federal government websites often end in gov or mil. Say for example you want to withhold 50 from each paycheck.

Overview of Nevada Taxes. Before sharing sensitive information make sure youre on a federal government site. You can calculator your commission by multiplying the sale amount by the commission percentage.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Public policy in California has long favored the full and prompt payment of wages due an employee. There is a line on the W-4 that allows you to specify additional withholding. The simplest way to change how much tax is withheld from your paycheck is to ask your employer to withhold a specific dollar amount from each of your paychecks.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

A financial advisor in Wisconsin can help you understand how taxes fit into your overall financial goals. Securities and Exchange Commission as an investment adviser. Overview of Maryland Taxes Maryland has a progressive income tax.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Your household income location filing status and number of personal exemptions.

Is registered with the US. One of the simplest ways to change the size of your paycheck. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

By offering a competitive rate youre. Flexible hourly monthly or annual pay rates bonus or other earning items. Your household income location filing status and number of personal exemptions.

Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Nevadas property tax rates are among the lowest in the US. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

A financial advisor in Minnesota can help you understand how taxes fit into your overall financial goals. How You Can Affect Your West Virginia Paycheck. Exempt means the employee does not receive overtime pay.

The decisions you make when completing your Form W-4. SmartAssets services are limited to referring users to third party registered. How You Can Affect Your Arizona Paycheck.

How You Can Affect Your Minnesota Paycheck. If you want to adjust the size of your paycheck first look to. Switch to California salary calculator.

Our real estate commission calculator will help you estimate your total realtor commission fees and net profit after closing costs and loan payoff when selling your home based on your target sales price. This California hourly paycheck calculator is perfect for those who are paid on an hourly basis. The states average effective property tax rate is just 053 which is well below the national average of 107.

The gov means its official. Your household income location filing status and number of personal exemptions. If you consistently find yourself owing.

Then enter the employees gross salary amount. California Salary Paycheck Calculator. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Computes federal and state tax withholding for paychecks. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

For the 2021 tax year Oklahomas top income tax rate is 5.

4 Ways To Calculate Commission

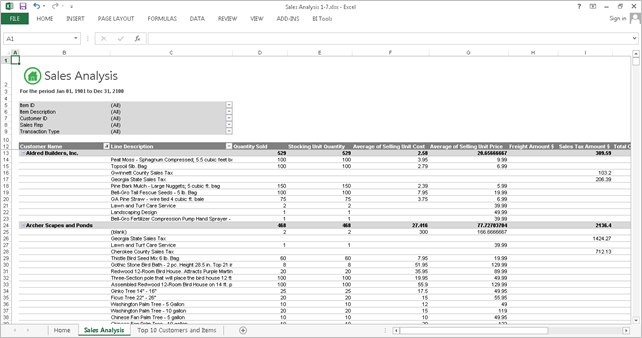

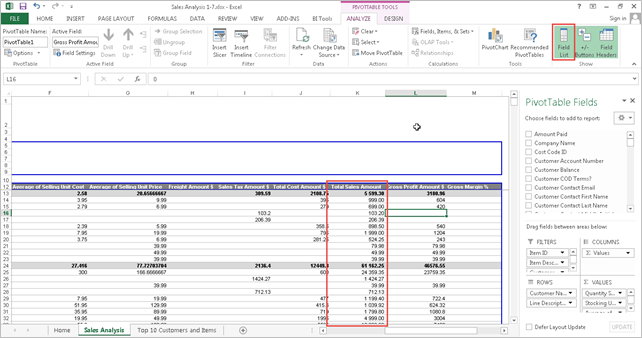

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Take Home Pay Calculator

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

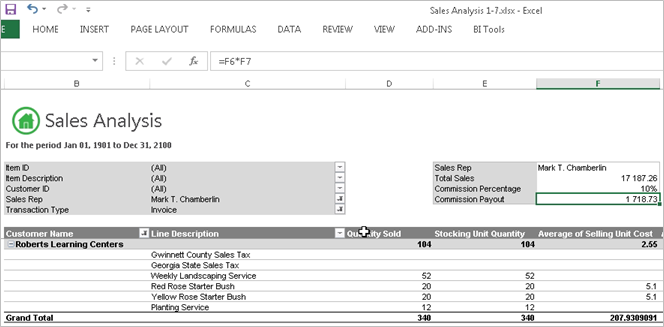

Learn How To Create A Sales Commission Calculator

Learn How To Create A Sales Commission Calculator

Calculating Commission And Gross Pay Youtube

Paycheck Calculator Take Home Pay Calculator

Real Estate Commission Calculator Templates 8 Free Docs Xlsx Pdf Real Estate Real Estate Infographic Real Estate Agent

Commission Calculator

10 Typical Sales Commission Structures To Motivate Reps With Examples

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Chapter 01 Salary And Commission Calculator Personal Finance

Commission Calculator Sales Commission Real Estate Commission Calculator

Wintax Calculator Wintax Canadian Payroll Software

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Payroll Formula Step By Step Calculation With Examples